1096 Form Printable 2025 - Fill, Sign Online, Download & Print - No Signup

Attention filers of Form 1096:

This form is provided for informational purposes only. It appears in red, similar to the official

IRS form. The official printed version of this IRS form is scannable, but a copy, printed from

this website, is not. Do

not

print and file a Form 1096 downloaded from this website; a

penalty may be imposed for filing with the IRS information return forms that can’t be

scanned. See part O in the current General Instructions for Certain Information Returns,

available at

www.irs.gov/form1099

, for more information about penalties.

To order official IRS information returns, which include a scannable Form 1096 for filing with

the IRS, visit

www.IRS.gov/orderforms

. Click on

Employer and Information Returns

, and

we’ll mail you the forms you request and their instructions, as well as any publications you

may order.

Information returns may also be filed electronically. To file electronically, you must have

software, or a service provider, that will create the file in the proper format. More information

can be found at:

•

IRS Filing Information Returns Electronically (FIRE) system (visit

www.IRS.gov/FIRE

), or

•

IRS Affordable Care Act Information Returns (AIR) program (visit

www.IRS.gov/AIR

).

See IRS Publications 1141, 1167, and 1179 for more information about printing these tax

forms.

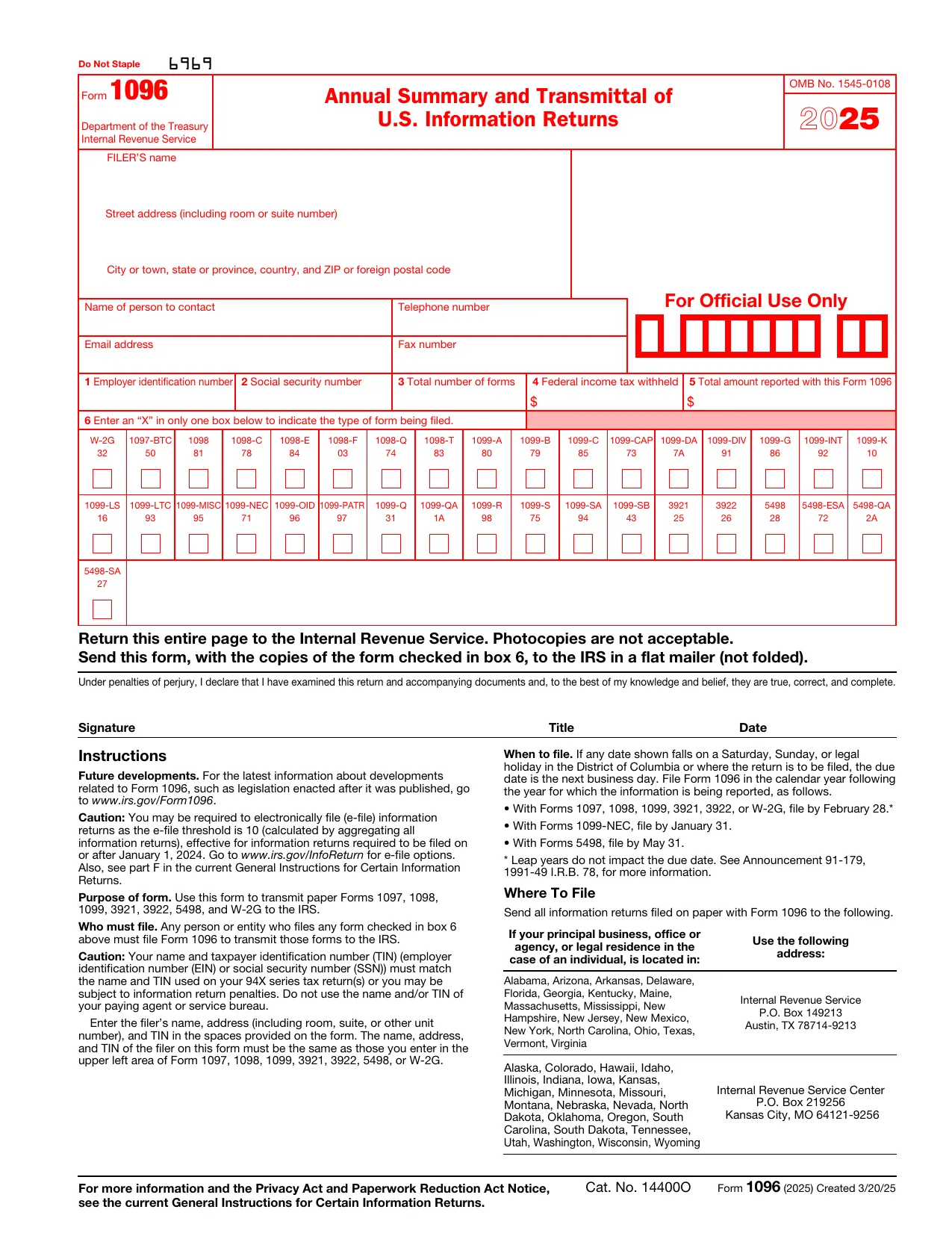

Do Not Staple

6969

Form

1096

Department of the Treasury

Internal Revenue Service

Annual Summary and Transmittal of

U.S. Information Returns

OMB No. 1545-0108

20

25

FILER’S name

Street address (including room or suite number)

City or town, state or province, country, and ZIP or foreign postal code

Name of person to contact

Telephone number

Email address

Fax number

For Official Use Only

1

Employer identification number

2

Social security number

3

Total number of forms

4

Federal income tax withheld

$

5

Total amount reported with this Form 1096

$

6

Enter an “X” in only one box below to indicate the type of form being filed.

W-2G

32

1097-BTC

50

1098

81

1098-C

78

1098-E

84

1098-F

03

1098-Q

74

1098-T

83

1099-A

80

1099-B

79

1099-C

85

1099-CAP

73

1099-DA

7A

1099-DIV

91

1099-G

86

1099-INT

92

1099-K

10

1099-LS

16

1099-LTC

93

1099-MISC

95

1099-NEC

71

1099-OID

96

1099-PATR

97

1099-Q

31

1099-QA

1A

1099-R

98

1099-S

75

1099-SA

94

1099-SB

43

3921

25

3922

26

5498

28

5498-ESA

72

5498-QA

2A

5498-SA

27

Return this entire page to the Internal Revenue Service. Photocopies are not acceptable.

Send this form, with the copies of the form checked in box 6, to the IRS in a flat mailer (not folded).

Under penalties of perjury, I declare that I have examined this return and accompanying documents and, to the best of my knowledge and belief, they are true, correct, and complete.

Signature

Title

Date

Instructions

Future developments.

For the latest information about developments

related to Form 1096, such as legislation enacted after it was published, go

to

www.irs.gov/Form1096

.

Caution:

You may be required to electronically file (e-file) information

returns as the e-file threshold is 10 (calculated by aggregating all

information returns), effective for information returns required to be filed on

or after January 1, 2024. Go to

www.irs.gov/InfoReturn

for e-file options.

Also, see part F in the current General Instructions for Certain Information

Returns.

Purpose of form.

Use this form to transmit paper Forms 1097,

1098,

1099, 3921, 3922, 5498, and W-2G to the IRS.

Who must file.

Any person or entity who files any form checked in box 6

above must file Form 1096 to transmit those forms to the IRS.

Caution:

Your name and taxpayer identification number (TIN) (employer

identification number (EIN) or social security number (SSN)) must match

the name and TIN used on your 94X series tax return(s) or you may be

subject to information return penalties. Do not use the name and/or TIN of

your paying agent or service bureau.

Enter the filer’s name, address (including room, suite, or other unit

number), and TIN in the spaces provided on the form. The name, address,

and TIN of the filer on this form must be the same as those you enter in the

upper left area of Form 1097, 1098, 1099, 3921, 3922, 5498, or W-2G.

When to file.

If any date shown falls on a Saturday, Sunday, or legal

holiday in the District of Columbia or where the return is to be filed, the due

date is the next business day. File Form 1096 in the calendar year following

the year for which the information is being reported, as follows.

• With Forms 1097, 1098, 1099, 3921, 3922, or W-2G, file by February 28.*

• With Forms 1099-NEC, file by January 31.

• With Forms 5498, file by May 31.

* Leap years do not impact the due date. See Announcement 91-179,

1991-49 I.R.B. 78, for more information.

Where To File

Send all information returns filed on paper with Form 1096 to the following.

If your principal business, office or

agency, or legal residence in the

case of an individual, is located in:

Use the following

address:

Alabama, Arizona, Arkansas, Delaware,

Florida, Georgia, Kentucky, Maine,

Massachusetts, Mississippi, New

Hampshire, New Jersey, New Mexico,

New York, North Carolina, Ohio, Texas,

Vermont, Virginia

Internal Revenue Service

P.O. Box 149213

Austin, TX 78714-9213

Alaska, Colorado, Hawaii, Idaho,

Illinois, Indiana, Iowa, Kansas,

Michigan, Minnesota, Missouri,

Montana, Nebraska, Nevada, North

Dakota, Oklahoma, Oregon, South

Carolina, South Dakota, Tennessee,

Utah, Washington, Wisconsin, Wyoming

Internal Revenue Service Center

P.O. Box 219256

Kansas City, MO 64121-9256

For more information and the Privacy Act and Paperwork Reduction Act Notice,

see the current General Instructions for Certain Information Returns.

Cat. No. 14400O

Form

1096

(2025) Created 3/20/25

Form 1096 (2025)

Page

2

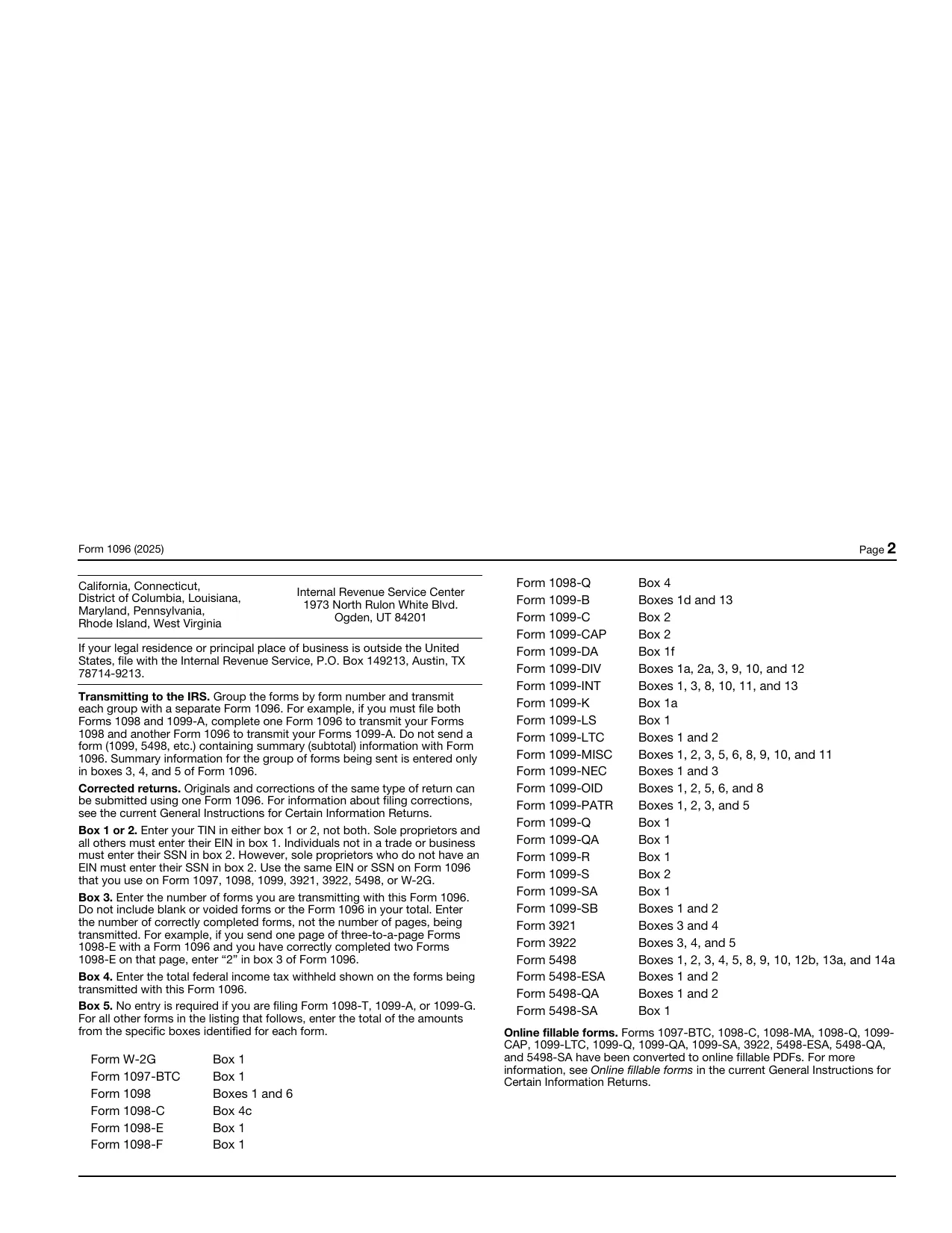

California, Connecticut,

District of Columbia, Louisiana,

Maryland, Pennsylvania,

Rhode Island, West Virginia

Internal Revenue Service Center

1973 North Rulon White Blvd.

Ogden, UT 84201

If your legal residence or principal place of business is outside the United

States, file with the Internal Revenue Service, P.O. Box 149213, Austin, TX

78714-9213.

Transmitting to the IRS.

Group the forms by form number and

transmit

each group with a separate Form 1096. For example, if you

must file both

Forms 1098 and 1099-A, complete one Form 1096 to

transmit your Forms

1098 and another Form 1096 to transmit your

Forms 1099-A. Do not send a

form (1099, 5498, etc.) containing

summary (subtotal) information with Form

1096. Summary

information for the group of forms being sent is entered only

in

boxes 3, 4, and 5 of Form 1096.

Corrected returns.

Originals and corrections of the same type of return can

be submitted using one Form 1096. For information about filing corrections,

see the current General Instructions for Certain Information Returns.

Box 1 or 2.

Enter your TIN in either box 1 or 2, not both. Sole proprietors and

all others must enter their EIN in box 1. Individuals not in a trade or business

must enter their SSN in box 2. However, sole proprietors who

do not have an

EIN must enter their SSN in box 2. Use the same EIN

or SSN on Form 1096

that you use on Form 1097, 1098, 1099,

3921, 3922, 5498, or W-2G.

Box 3.

Enter the number of forms you are transmitting with this Form

1096.

Do not include blank or voided forms or the Form 1096 in your

total. Enter

the number of correctly completed forms, not the number

of pages, being

transmitted. For example, if you send one page of

three-to-a-page Forms

1098-E with a Form 1096 and you have

correctly completed two Forms

1098-E on that page, enter “2” in box

3 of Form 1096.

Box 4.

Enter the total federal income tax withheld shown on the

forms being

transmitted with this Form 1096.

Box 5.

No entry is required if you are filing Form 1098-T, 1099-A, or

1099-G.

For all other forms in the listing that follows, enter the total of the amounts

from the

specific boxes identified for each form.

Form W-2G

Box 1

Form 1097-BTC

Box 1

Form 1098

Boxes 1 and 6

Form 1098-C

Box 4c

Form 1098-E

Box 1

Form 1098-F

Box 1

Form 1098-Q

Box 4

Form 1099-B

Boxes 1d and 13

Form 1099-C

Box 2

Form 1099-CAP

Box 2

Form 1099-DA

Box 1f

Form 1099-DIV

Boxes 1a, 2a, 3, 9, 10, and 12

Form 1099-INT

Boxes 1, 3, 8, 10, 11, and 13

Form 1099-K

Box 1a

Form 1099-LS

Box 1

Form 1099-LTC

Boxes 1 and 2

Form 1099-MISC

Boxes 1, 2, 3, 5, 6, 8, 9, 10, and 11

Form 1099-NEC

Boxes 1 and 3

Form 1099-OID

Boxes 1, 2, 5, 6, and 8

Form 1099-PATR

Boxes 1, 2, 3, and 5

Form 1099-Q

Box 1

Form 1099-QA

Box 1

Form 1099-R

Box 1

Form 1099-S

Box 2

Form 1099-SA

Box 1

Form 1099-SB

Boxes 1 and 2

Form 3921

Boxes 3 and 4

Form 3922

Boxes 3, 4, and 5

Form 5498

Boxes 1, 2, 3, 4, 5, 8, 9, 10, 12b, 13a, and 14a

Form 5498-ESA

Boxes 1 and 2

Form 5498-QA

Boxes 1 and 2

Form 5498-SA

Box 1

Online fillable forms.

Forms 1097-BTC, 1098-C, 1098-MA, 1098-Q, 1099-

CAP, 1099-LTC, 1099-Q, 1099-QA, 1099-SA, 3922, 5498-ESA, 5498-QA,

and 5498-SA have been converted to online fillable PDFs. For more

information, see

Online fillable forms

in the current General Instructions for

Certain Information Returns.